Student Loan Interest Rates Average . Find current rates and averages in our guide. Annual percentage rate apr vs interest.

Our loans don’t require cosigners, collateral or a credit history. Department for education, student loans company, and andrea jenkyns mp. However, some borrowers could qualify for rates as low as 1.04% while others might pay as much as 12.99% or more for their loans.

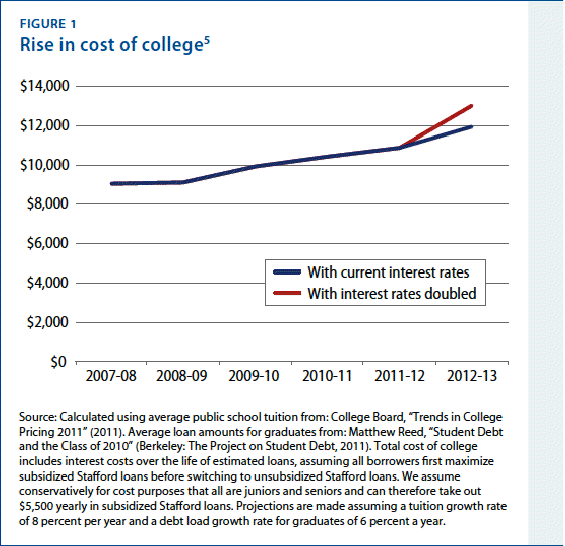

Student Loan Interest Rates Average. Student loan interest rates to be capped at 6.3% from september 2022 due to market rates. Private student loan interest rates typically exceed federal rates. Federal student loan interest rates were fixed at 6.8% from 2006 to 2013. Annual percentage rate apr vs interest. However, some borrowers could qualify for rates as low as 1.04% while others might pay as much as 12.99% or more for their loans. Ad mpower provides financing for international students studying in the u.s.

Student Loan Interest Rates Average ~ As We know recently is being searched by users around us, maybe one of you. People now are accustomed to using the net in gadgets to view video and image information for inspiration, and according to the title of the post I will talk about about Student Loan Interest Rates Average .

The 2016 survey, released in 2017, gave a more specific data. Many private student loan lenders offer both fixed and variable interest rates, enabling eligible borrowers to choose the option they prefer. The current interest rates for federal student loans disbursed between july 1, 2021 and july 1, 2022 have been set at: Our loans don’t require cosigners, collateral or a credit history. Department for education, student loans company, and andrea jenkyns mp. According to the 2019 survey, student loan borrowers who were repaying loans made a “typical” monthly loan payment of $200 to $299. However, some borrowers could qualify for rates as low as 1.04% while others might pay as much as 12.99% or more for their loans. Your interest rate will be based on the lender’s requirements. Federal student loan interest rates were fixed at 6.8% from 2006 to 2013. • 3.73% for direct subsidized loans and direct unsubsidized loans for undergraduate students • 5.28% for unsubsidized loans for graduate or professional students • 6.28% direct plus. Annual percentage rate apr vs interest.

Student Loan Interest Rates Average Our loans don’t require cosigners, collateral or a credit history.

However, some borrowers could qualify for rates as low as 1.04% while others might pay as much as 12.99% or more for their loans. Those interest rates can cause your loans to balloon. Student loan interest rates depend on the loan type and borrower. Any amount paid over that should apply to the principal loan amount. According to the 2019 survey, student loan borrowers who were repaying loans made a “typical” monthly loan payment of $200 to $299. Ad mpower provides financing for international students studying in the u.s. Many private student loan lenders offer both fixed and variable interest rates, enabling eligible borrowers to choose the option they prefer. The better your interest rate, the. Education data reports that the overall average private student loan rate varies between 6% and 7%. • 3.73% for direct subsidized loans and direct unsubsidized loans for undergraduate students • 5.28% for unsubsidized loans for graduate or professional students • 6.28% direct plus. Department for education, student loans company, and andrea jenkyns mp.

If you re searching for Student Loan Interest Rates Average you've reached the perfect place. We have 20 images about Student Loan Interest Rates Average including pictures, photos, pictures, backgrounds, and much more. In such page, we additionally provide number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Your interest rate will be based on the lender’s requirements.

Our loans don’t require cosigners, collateral or a credit history. Average interest rates can range from 3.95% annual percentage rate (apr) to 14.28% apr. Ad mpower provides financing for international students studying in the u.s. Those interest rates can cause your loans to balloon. After that, the bipartisan student loan certainty act took effect, which affected unsubsidized loans. Unfortunately, many borrowers with private loans are paying more interest than they need to. Our loans don’t require cosigners, collateral or a credit history. Your interest rate will be based on the lender’s requirements. Ad mpower provides financing for international students studying in the u.s. According to the 2019 survey, student loan borrowers who were repaying loans made a “typical” monthly loan payment of $200 to $299. The current interest rates for federal student loans disbursed between july 1, 2021 and july 1, 2022 have been set at: